Get This Report on "The Top 5 Online Checking Accounts for Easy Banking"

Handling Your Funds: How a Checking Account Can easily Assist You Budget Better

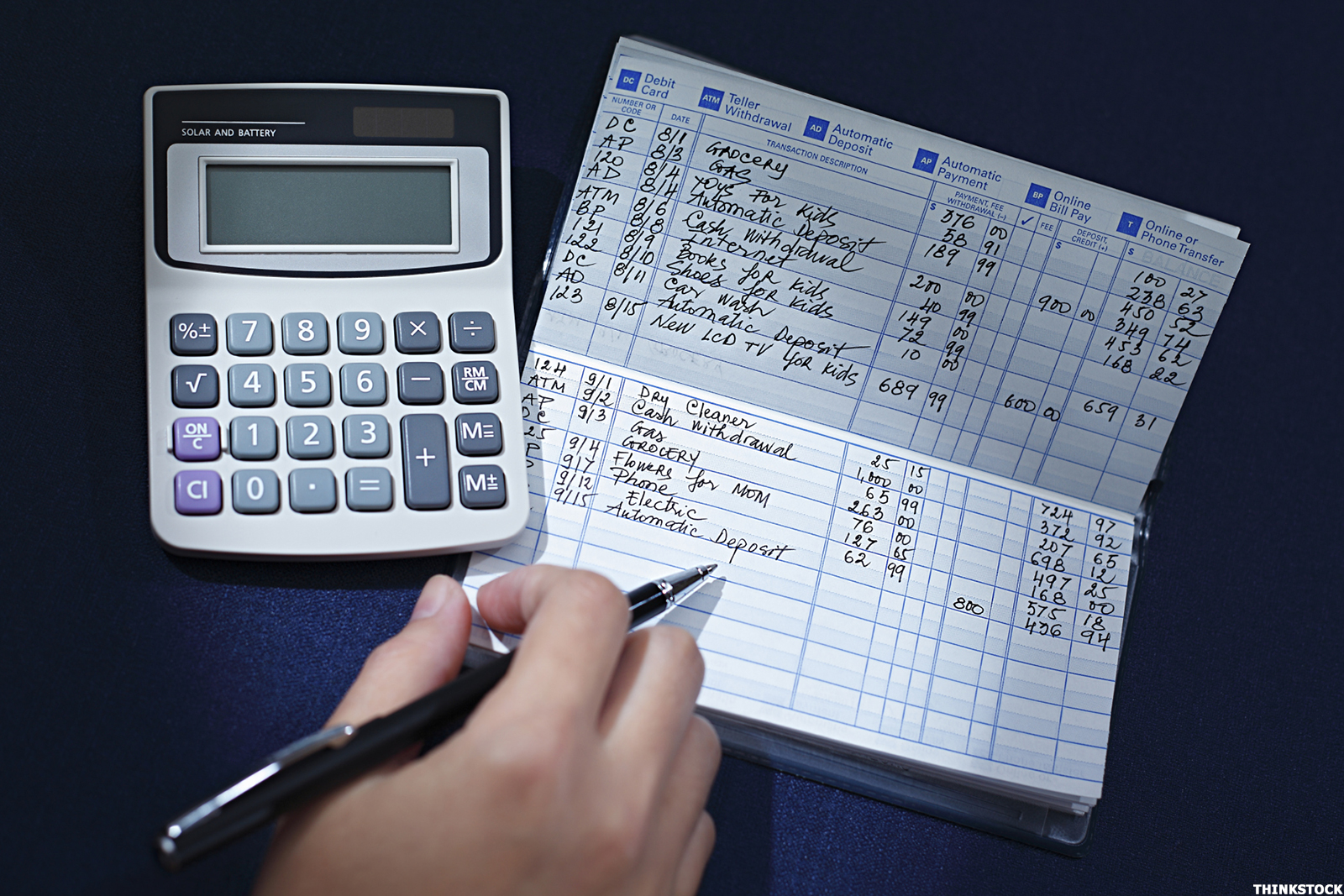

Dealing with your finances properly can be a daunting duty. This Is Cool needs technique, planning, and a commitment to sticking to your spending plan. One of the very most efficient methods to manage your funds is through opening and utilizing a inspection profile. A inspection account can aid you budget much better by offering you with resources and sources that help make it simpler to always keep keep track of of your costs, save loan, and consider for the future.

In this write-up, we’ll explore the perks of making use of a checking account as component of your total economic control method. We’ll also deliver some recommendations on how you may get began along with position and using a examination profile.

What is a Checking Account?

A inspection account is a type of banking company profile that permits you to deposit and take out loan as needed. It’s developed for day-to-day transactions such as paying for expenses, creating purchases, and taking out cash coming from ATMs.

Checking profiles normally happen with component such as money cards, on-line banking accessibility, mobile phone financial apps, and check-writing opportunities. These function produce it simple to handle your loan on the go while keeping monitor of all your deals in real-time.

Perks of Utilizing a Checking Account

There are several perks to making use of a inspection account as part of your financial administration strategy:

1. Far better Monitor of Spending - A examination profile provides an easy method to maintain keep track of of all your expenses in one location. Along with internet banking or mobile phone apps, you can look at all deals in real-time and sort them by type (e.g., groceries or home entertainment). This creates it much easier to see where you’re spending too much or where you may be able to cut back.

2. No More Cash Hassles - Carrying cash can be annoying and dangerous. Along with a debit memory card connected to your examination account, you possess gain access to to funds wherever Visa or Mastercard are approved – without possessing to hold cash around city.

3. Avoid Overdraft Fees - Overdraft expenses can easily be pricey, but making use of a examination account may assist you prevent them. You may established up warning to advise you when your account balance is low, and a lot of banks supply overdraft security choices to help protect against unintended over-limits.

4. Earn Interest - Some checking accounts use enthusiasm on your profile equilibrium, which suggests you can easily get loan on your amount of money without having to open a different financial savings profile.

5. Bill Pay Helped make Easy - Several checking accounts come along with bill salary function that make it possible for you to pay out bills online or via the bank’s mobile phone application. This spares time and difficulty and makes sure that costs are paid out on opportunity.

Getting Began with a Checking Account

If you’re ready to open a inspection account, listed here are some tips to aid get began:

1. Investigation Different Banks - Not all banking companies are developed equal, so it’s vital to investigate different options prior to selecting one. Consider elements such as fees, passion fees, on the web financial gain access to, and mobile phone apps when matching up different financial institutions.

2. Decide on the Right Account Type - There are actually numerous styles of examining accounts accessible depending on your needs (e.g., general or interest-bearing). Pick the one that most ideal accommodates your way of life and financial goals.

3. Understand Expenses & Charges- The majority of banking companies charge fees for certain solutions like ATM withdrawals or inspect writing beyond a specific limitation in a month etc . Create certain you know these fees upfront so they don’t record you off protection eventually.

4. Use Budgeting Tools - Several banks offer budgeting tools online or with their mobile phone apps that make it quick and easy to track investing and keep within your spending plan.

5. Set Up Auto-Savings Transfers- An effortless means to spare funds is by establishing up automated moves from your inspection profile into a savings profile each month..

Conclusion

In final thought, managing finances properly is crucial for long-term economic stability and excellence. Using a checking account as component of your overall economic control approach can easily help you budget much better, monitor investing, spare loan, and prepare for the future. Through following the recommendations described in this write-up, you can get began along with position and making use of a checking account that is right for you.